- Impact Growth Capital Newsletter

- Posts

- Impact Growth Capital Newsletter

Impact Growth Capital Newsletter

IGC Market Outlook: Why 2026 Is a Defining Year for Essential Housing

This week at IGC:

Why Workforce and Senior Housing Are Positioned to Lead in 2026

Impact Growth Fund

Join Us In Solving The Affordable Housing Crisis

Own a Piece of the GP — Not Just the Fund

For the first time, accredited investors can access General Partner economics — including a share of management fees, promote, and equity. This insider structure is typically reserved for founding partners and offers revenue-based participation. A rare, strategic opportunity to own a piece of the GP is now open.

Click here to learn more from a previous newsletter.

To Our Partners and Investors,

At Impact Growth Capital (IGC), we don’t chase headlines we chase fundamentals.

As we close the book on 2025, the multifamily sector is emerging from a year defined by what many have called a “great reset.” While much of the market particularly luxury Class A spent the year digesting a multi-decade high in new supply, our focus areas told a very different story.

For workforce housing (Class B/C) and senior living, 2025 was not a year of retreat, but one of resilience.

Below is our retrospective on the market dynamics of 2025 and why we believe 2026 presents a rare and compelling window for mission-driven capital.

2025 in Review: A Tale of Two Markets

The defining characteristic of 2025 was a massive influx of new luxury inventory. Developers chased premium rents, leaving the affordable sector largely untouched by new supply yet increasingly pressured by rising operating costs.

The long-promised “trickle-down” effect failed to materialize.

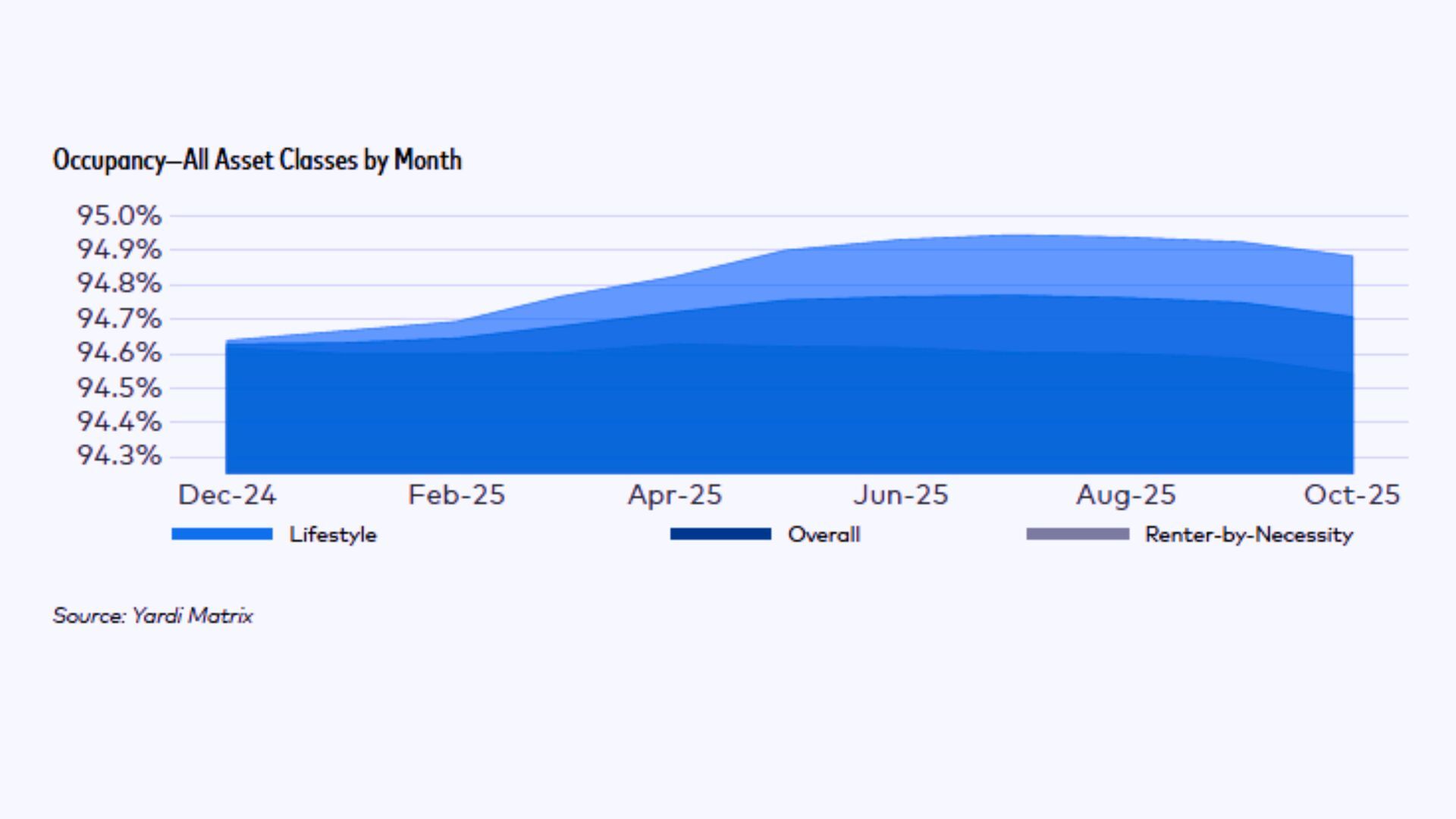

While Class A vacancy rates softened under oversupply, Class B and C assets remained tight. High interest rates and persistent inflation kept renters by necessity firmly in place. They could neither purchase homes nor upgrade into luxury units.

Operational headwinds added further pressure. Insurance premiums and labor costs spiked, compressing Net Operating Income (NOI). This environment flushed out “tourist capital” operators who relied on thin margins and quick exits rather than durable fundamentals.

As anticipated, distress emerged. Variable-rate loans on over-leveraged assets began to crack. Importantly, we are seeing properties come to market not because the real estate failed but because the capital structure did.

Key Takeaway:

The “need-based” sectors (workforce and affordable housing) outperformed the “want-based” luxury sector in occupancy stability, reinforcing their defensive nature during economic softness.

The 2026 Outlook: The Supply Cliff

If 2025 was defined by oversupply, 2026 will be defined by scarcity.

Construction starts fell sharply in 2024 and 2025 due to high financing costs. As a result, by late 2026 and into 2027, new deliveries will slow to a near halt a phenomenon we refer to as the “Supply Cliff.”

For IGC, this environment creates three distinct advantages:

Vacancy Compression: With virtually no new affordable units coming online and demand remaining steady, Class B/C vacancy rates are expected to tighten further.

Sustainable Rent Growth: Modest rent growth should return not the unsustainable spikes of 2021, but disciplined increases driven by wage growth and limited supply.

Valuation Recovery: While cap rates have widened, pricing is stabilizing as the market adjusts to a “higher-for-longer” interest rate reality.

Institutional Validation: Smart Capital Is Pivoting

This thesis is no longer contrarian.

The recently released ULI–PwC Emerging Trends in Real Estate 2026 report confirms a meaningful shift in institutional sentiment. While traditional multifamily remains core, investors are increasingly reallocating toward workforce and senior housing.

Institutional capital is moving away from luxury speculation and toward durable, needs-based sectors recognizing them not as niche strategies, but as essential, defensive allocations for long-term portfolios.

The “Silver Tsunami”: Our Expansion into Senior Housing

Alongside workforce housing, IGC is aggressively expanding into naturally occurring senior housing.

The demographics are undeniable. In 2026, the first Baby Boomers turn 80.

This surge in demand is colliding with a construction drought. Senior housing inventory growth has slowed to approximately 0.7% annually, while demand continues to set records.

Senior housing aligns seamlessly with the IGC mission. Like workforce housing, it is a needs-based, recession-resilient asset class. Aging is inevitable, regardless of economic cycles.

By acquiring stabilized senior assets, we aim to:

Provide security and dignity for a vulnerable population

Deliver steady, bond-like cash flow for our investors

Why Affordable Housing Is the Asset Class of 2026

As luxury and lifestyle assets soften, the renter-by-necessity base remains stable. Elevated interest rates continue to keep homeownership out of reach for many, solidifying long-term rental demand.

For IGC, this reinforces our core thesis.

We are not underwriting aggressive rent growth. We are underwriting:

High occupancy

Operational efficiency

Income stability

Section 8 and other government-backed rental programs provide a durable revenue floor through Housing Assistance Payment (HAP) contracts. In an environment economists increasingly describe as a “jobless expansion,” luxury assets feel pressure first. Affordable and senior housing remain essential.

Our Strategy: Capital with Conscience

We enter 2026 with clarity and conviction.

IGC is actively acquiring assets from fatigued owners who lack the operational bandwidth to navigate today’s environment. Our focus remains on preservation, impact, and discipline.

We are:

Acquiring Class B/C and senior assets below replacement cost

Investing in safety, efficiency, and community upgrades that reduce turnover

Structuring capital stacks designed to withstand prolonged higher interest rates

The window to acquire essential housing assets before the supply shortage fully materializes is now.

We are positioning Impact Growth Capital to be the buyer of choice for essential housing delivering durable returns for our investors while preserving dignity and stability for our residents.

Thank you for your continued trust and partnership.

Warm regards,

Jesse Sells

Founder | Impact Growth Capital

Have a topic or question you want to see covered? Reply directly to this email.

Let’s Discuss the 2026 Opportunity

If you’d like to explore how Impact Growth Capital is positioning for the supply cliff and essential housing acquisitions, we invite you to schedule a brief conversation with us.