- Impact Growth Capital Newsletter

- Posts

- Impact Growth Capital Newsletter

Impact Growth Capital Newsletter

LIHTC has supported more than 3.6 million units since 1986

This Week at IGC:

LIHTC has supported more than 3.6 million units since 1986

How Affordable Housing Gets Built

Listen to the latest episode of The Disruptive Capitalist.

In a candid discussion, John Makarewicz reflects on a recent disappointment—a promising real estate deal that collapsed after the seller was swayed by a larger investor. But for John, the story doesn’t end there. He’s preparing to submit a more competitive offer, underscoring his commitment to tenacity and creativity in today’s complex real estate environment.

How Affordable Housing Gets Built: An Interactive Look at the Capital Stack

Most people know affordable housing is important, but few understand the complex financing puzzle required to get a project built. Between land costs, construction expenses, and long-term affordability requirements, it takes more than just one funding source to make a deal work.

That’s why I want to share a resource I think you’ll find fascinating: the Urban Institute’s interactive tool, “How Affordable Housing Gets Built”. It walks you step by step through the sources of capital that go into a typical affordable housing development. With simple graphics, sliders, and clear explanations, it makes the financing stack come alive.

Click here to explore the tool

The tool highlights the four major ingredients of affordable housing finance:

Debt – Loans from banks or bond financing cover a portion of costs.

Equity – Investors bring capital.

Public subsidies – Local and state governments may contribute grants or soft loans.

Tax credits – Programs like the Low-Income Housing Tax Credit (LIHTC) bring equity into deals by giving investors a federal credit in exchange for funding affordable units.

What becomes clear is that no single piece is enough on its own. Affordable housing only comes together through a carefully balanced blend of all four sources.

Even if every project you pursue isn’t 100% affordable, many developers are increasingly incorporating affordable or workforce components into otherwise market-rate projects. Here’s why:

Competitive advantage in RFPs. Cities often give preference to proposals that mix affordability with market-rate housing.

Financial stability. LIHTC and subsidies reduce reliance on high-cost debt, which is critical in today’s interest rate environment.

Investor appeal. Many investors are eager to back projects that combine financial return with measurable community benefit.

By layering in affordable housing tools, developers can unlock new funding sources and deliver mixed-income communities that perform both socially and financially.

The Lasting Impact of LIHTC

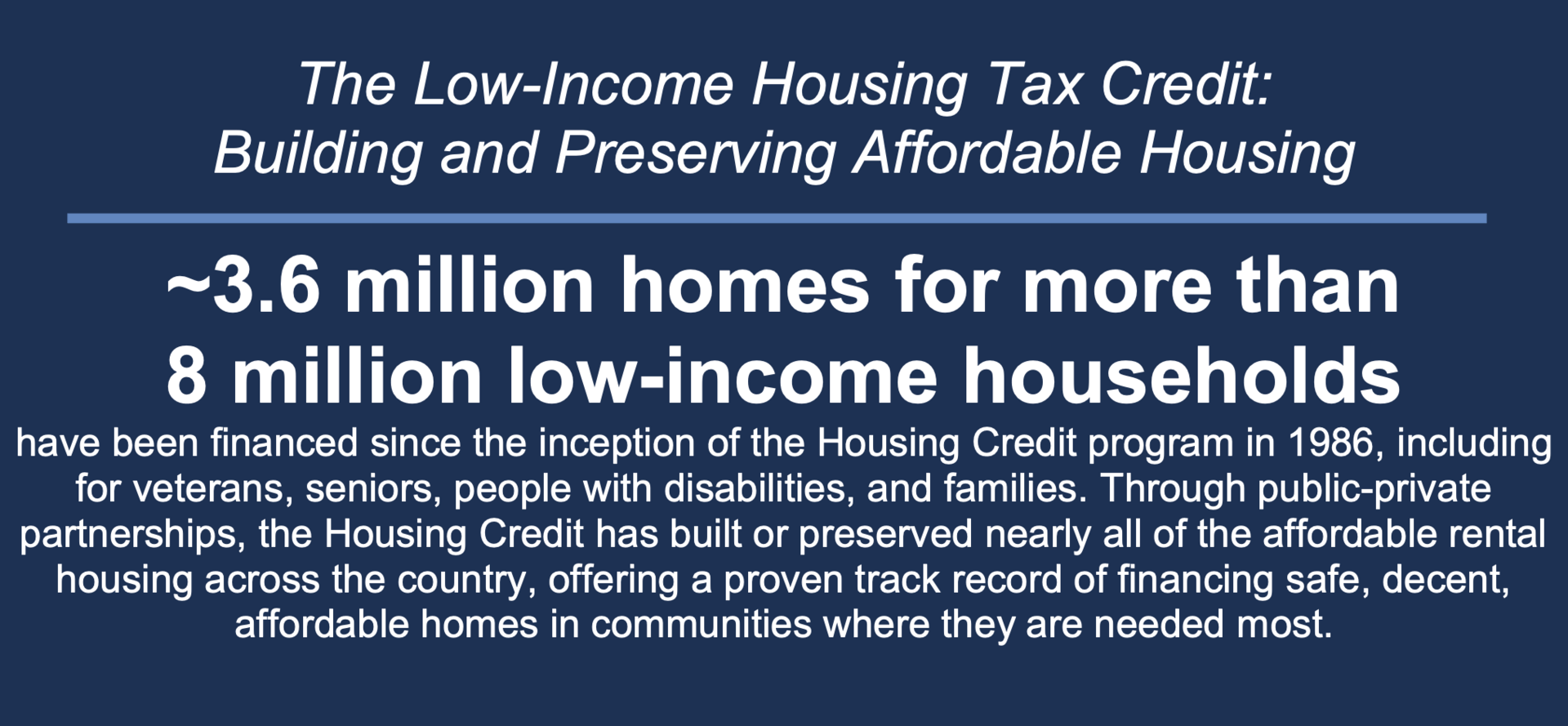

Since its creation in 1986, the Low-Income Housing Tax Credit (LIHTC) has been the single most important driver of affordable housing production in the United States. Enacted as part of the Tax Reform Act under President Reagan, the program was designed to harness private capital for public good, offering tax incentives to investors who fund the construction and rehabilitation of rental housing reserved for low- and moderate-income households. Nearly four decades later, the results speak for themselves: LIHTC has supported the development of more than 3.6 million units nationwide, housing millions of families who might otherwise have been left out of stable, quality housing.

The success of LIHTC lies in its ability to bridge the financing gap that traditional debt and equity cannot fill. Affordable housing projects often generate less rental income than market-rate apartments, making them difficult to finance without subsidy. By attracting equity through tax credits, LIHTC reduces reliance on high-cost debt and creates a more sustainable capital stack. This approach has not only produced new units but also preserved existing affordable housing, ensuring communities retain long-term affordability. As the Harvard Joint Center for Housing Studies and groups like the ACTION Campaign note, the program remains a cornerstone of U.S. housing policy.

Looking forward, LIHTC’s legacy of 3.6 million homes underscores both its scale and its necessity. With more than 325,000 units set to reach the end of their affordability period in the next five years, the need for continued investment and modernization of the program is urgent. By layering tax credits with grants, RFPs, and other innovative financing, today’s projects can replicate the program’s long-proven impact: building communities that are financially viable, socially inclusive, and positioned to meet the growing demand for rental housing.

Have a topic or question you want to see covered? Reply directly to this email.