- Impact Growth Capital Newsletter

- Posts

- Impact Growth Capital Newsletter

Impact Growth Capital Newsletter

CRE’s $250B Opportunity: How 29% Risk Buffer Changes Everything.

This week at IGC:

Risk-engineered deals are deploying first. See how 29% downside protection meets $250B in dry powder.

Impact Growth Fund

Join Us In Solving The Affordable Housing Crisis

Own a Piece of the GP — Not Just the Fund

For the first time, accredited investors can access General Partner economics — including a share of management fees, promote, and equity. This insider structure is typically reserved for founding partners and offers revenue-based participation. A rare, strategic opportunity to own a piece of the GP is now open.

Click here to learn more from a previous newsletter.

This Cycle Won’t Reward Waiting It Will Reward Structure

Most investors are waiting for certainty.

The smart ones are engineering it.

Capital is moving again but not evenly.

After years on the sidelines, private real estate funds are starting to deploy again, with $250B in North American dry powder ready to chase yield and stability.

The next phase of commercial real estate won’t be defined by broad rebounds or rising tides.

It will be defined by selective deployment into deals that reduce risk before returns are projected.

That’s where this cycle separates speculators from disciplined capital.

THE MARKET CONTEXT: WHERE CAPITAL IS FLOWING

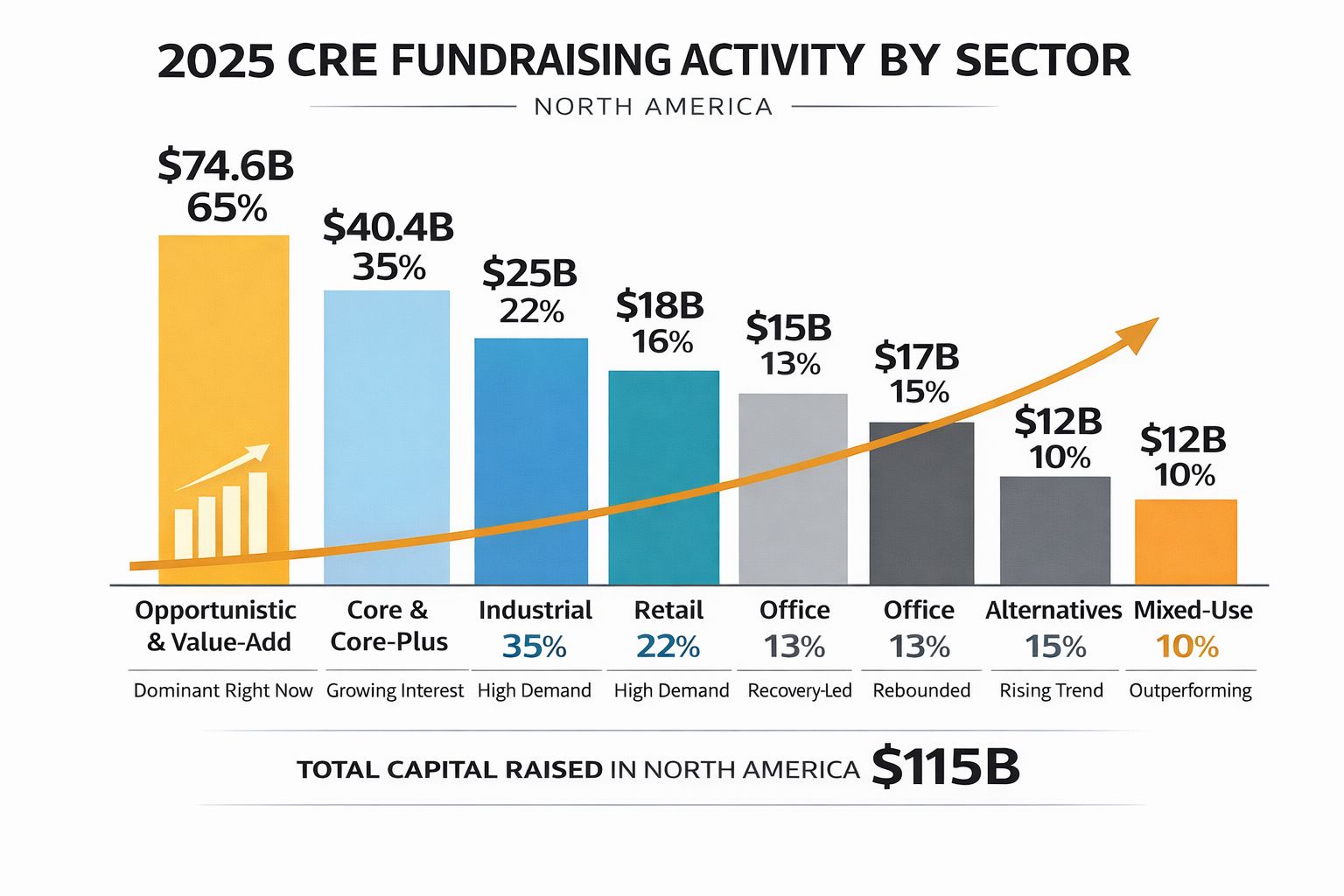

Regaining confidence: Private real estate funds raised $164.4B globally in 2025, $115B targeting North America

Strategy shifts: Opportunistic/value-add deals dominated 65% of fundraising, but institutional capital is pivoting back to core and core-plus for stability

Asset sales: Industrial and retail led the rebound (+16% and +21%), while office deals jumped +24% by Q3

Investor preferences: Flex industrial (60% of investors) and grocery-anchored retail are in demand, while alternatives like medical office, self-storage, and data centers gain momentum

With $250B in dry powder waiting, 2026 is poised to be a pivotal year for CRE deployment. Early, structured, and de-risked plays will outperform speculative positioning.

WHAT’S ACTUALLY WORKING RIGHT NOW

As capital re-enters the market, we’re seeing a clear pattern:

Investors are prioritizing structures over stories

Demand-driven assets are outperforming speculative plays

Capital stacks with built-in buffers deploy first

Mixed-use and alternative strategies absorb volatility better than single-use assets

In short:

Deals aren’t winning because markets are improving.

They’re winning because risk is engineered out early.

WHERE IMPACT GROWTH CAPITAL IS FOCUSED

Impact Growth Capital is preparing to open a Rule 506(c) real estate investment opportunity designed specifically for this phase of the cycle.

Rather than waiting for market clarity, this opportunity is built around:

Public-private alignment

Adaptive reuse with modern utility

Multiple income streams within a single asset

A capital stack designed to protect equity first

This is not a timing trade.

It’s a structure-driven deployment strategy, engineered to succeed as capital moves selectively.

THE COLORADO BUILDING: A DEPLOYMENT EXAMPLE

Located in downtown Pueblo, this shovel-ready adaptive reuse project transforms a 1925 icon into a vibrant mixed-use engine:

Residential Impact: 59 units of independent senior housing + 12 live/work lofts for veterans and entrepreneurs

Cultural Restoration: Full restoration of historic theater for civic and cultural use

Commercial Anchors: 20,000+ sq. ft. retail including café, artisan shops, and medical services

De-risked via incentives:

Historic Tax Credits: ~29% of total project costs

C-PACE Financing: Optimizes energy and capital efficiency

Investment Profile:

Target IRR: 30%

Target Average Cash-on-Cash: 14.1%

Target Equity Multiple: 3.2x

Pueblo is primed for growth: multifamily vacancy <6% and strong rental demand. The Colorado Building sits at Main St. & 4th Ave, perfectly positioned to capture this momentum.

THE IGC TAKEAWAY

This cycle will not reward waiting for clarity.

It will reward de-risked execution.

Approximately 29% of project costs are offset through public incentives before equity is fully exposed

Local multifamily vacancy sits below 6%, supporting near-term absorption

A diversified mixed-use structure reduces reliance on a single income stream

The capital stack absorbs volatility before returns are projected

As capital re-enters selectively, projects with embedded downside protection and real, current demand are positioned to deploy first—and perform earliest.

This is how disciplined capital moves ahead of the cycle, not behind it.

WHO THIS IS DESIGNED FOR

Accredited investors who:

Prefer structural risk reduction over speculation

Want capital working before trades become crowded

Value cash flow, downside protection, and long-term impact

Understand execution matters more than headlines

NEXT STEPS

Conversations with qualified accredited investors are opening this week.

Request access to review the full underwriting and offering memorandum through our onboarding process.

IMPORTANT DISCLOSURES

Impact Growth Capital is preparing to open a real estate investment opportunity under Rule 506(c) of Regulation D. Participation is available exclusively to accredited investors and requires independent verification.

This communication is for informational purposes only and does not constitute an offer to sell or solicitation to buy securities.

Jesse Sells

Founder | Impact Growth Capital

Schedule Your Accredited Investor Call

We’ll walk you through the capital stack, projected returns, and de-risked structure before equity is fully exposed.

Have a topic or question you want to see covered? Reply directly to this email.